Now is the time to be exploring your options and picking a health insurance plan for 2022.

The annual Open Enrollment Period begins November 1. This short article will give you an overview of what you need to have in mind as you choose a health plan in South Carolina for 2022.

Health Plans Available in South Carolina in 2022

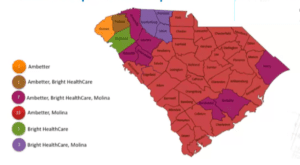

There are four health insurance companies offering plans on the Health Insurance Marketplace for South Carolina in 2022. Not all of them are in every county, however, so where you live will impact what options are available.

BlueCross BlueShield of SC is the only carrier offering plans in each county of South Carolina.

Molina Health, Ambetter, and Bright Health are also available in different parts of the state. See the map to find out what’s available in your county.

(Also note that BlueChoice HealthPlan has plans in South Carolina outside the Marketplace).

Provider Networks Are a Big Deal in South Carolina

Each health insurance company will have a different network of providers. You’ll want to be sure that your doctors and preferred hospital systems are part of the plan’s network before you sign up. (Unless, of course, you’re OK switching doctors.)

Because an increasing number of doctor groups are part of hospital systems, we tend to focus on which hospitals are part of a given network.

BlueCross BlueShield of SC has every hospital system in the state within their provider network. The other three carriers have some, but not all.

For example, in Greenville County, Bright Health and Molina Health do not include the Prisma Health hospital system, but both include Bon Secours St. Francis and the Spartanburg Regional system. Ambetter includes Prisma, but not the other two. Only BlueCross BlueShield includes all three hospital systems with a presence in Greenville county.

Bottom line: You’ll want to check the network before you enroll in a plan.

Expanded Premium Tax Credits (Subsidies) in 2022

There was a significant expansion of Obamacare subsidies that took effect in 2021. We want bore you with the details of how the formula changed, but suffice to say: If you haven’t been eligible in the past, you’ll definitely want to check again this year.

One thing is unchanged, however: If you are eligible for health insurance through an employer (yours or that of your spouse), then you won’t be eligible for discounted prices in the individual Health Insurance Marketplace. Sigh.

A smaller subset of people will also be eligible for “Cost Sharing Reductions” (CSR). These are subsidies that lower the out-of-pocket costs on silver plans. They are available to people who make between 100-250% of the Federal Poverty Level, which is based on your household size and income. If you qualify, you’ll get much better coverage with a silver plan than anything else.

Got Questions? We’re Happy to Help

We have helped hundreds of people enroll in Marketplace plans and will be happy to guide you through the process of selecting a plan and enrolling. Working with us will not cost you anything – you’ll pay the same price for your plan working with an expert or tackling it yourself.

We also utilize a third-party platform that streamlines the process and makes it dramatically more efficient and user-friendly to get quotes and enroll. Click the buttons below to try it out:

Click Here to See SC Marketplace Plans!See plans and prices and enroll if you're ready